Evaluating Expected Value

Expected Value is a perfect way of evaluating whether a bet could be profitable. Also, EV was even used by one mathematician to guarantee multiple lottery jackpot wins. However, despite its usefulness, the technique is new to many bettors. Know about Expected Value evaluation in betting here.

Expected Value(EV) is a tool used in a two-sided judgment to calculate relative values, such as ‘will a coin fall on heads or tails? ‘It does so by using an underlying matrix of decisions weighing up the upside and downside of the two choices.

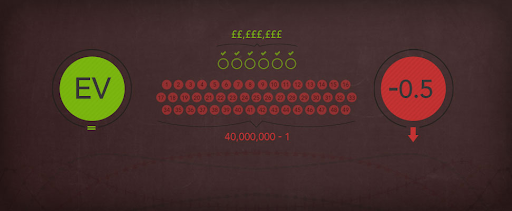

Betters often used to calculate the amount they may expect to win or lose on a given bet-with a positive EV suggesting a successful proposition. For example, the UK National Lottery has a negative EV of [-0.50p]you potentially lose 50p for every £1 invested, which means it’s not a good bet to create profit

Calculate Expected Value

The formula to measure the Expected Value is simple. Multiply the winning probability by the amount you will gain per bet, and deduct the losing probability multiplied by the amount you can lose per bet:

(Amount Gained by Bet x Winning Probability)-( Amount Lost by Bet x Losing Probability)

The simplest example of betting is a fair coin toss, in which two options are open. Imagine that you are betting £100 on the two outcomes, both of which pay out the same rate (probability of 0.5/2.0 in Decimal odds). It generates a decision matrix for either outcome, which has an EV of 0. It is because the probability of the two results is the same, and if you flip a coin forever, technically, you will only end up all square.

However, if we change the return on Heads to pay £110—thus a chance of 0.48 or 2.10 odds—this changes the formula, and generates a positive £5 EV for Heads backup. It means you would expect to earn an average of £5 on each £100 bet if you were to make the same bet on Heads repeatedly since the odds you got are higher than the expected odds of the case.

Expected Value of Coin Toss

| Choice: | Calculation (Heads – Tails): | EV |

| Heads | (£100 x 0.5) – (£100 x 0.5) | 0 |

| Tails | (£100 x 0.5) – (£100 x 0.5) | 0 |

EV of Coin Toss (£11 return on Heads)

| Choice: | Calculation (Heads – Tails): | EV |

| Heads | (£110 x 0.5) – (£100 x 0.5) | £5 |

| Tails | (£10 x 0.5) – (£10 x 0.5) | 0 |

You will accept his offer quickly, anyone who gives you a chance because you will not fail in the long run. And emphasizing this is necessary for the long term since EV is theoretical.

Use EV to Win the lottery

EV emerged back in the 17th century after a debate of payouts for dice games between a trio of famous mathematicians. One of them, Blaise Pascal – who later became famous for his work on binomial expansions (Pascal’s Triangle) – was the first to use the notion of Expected Value as he dealt with a much more severe problem – God’s existence.

Years later, Romanian mathematician, Stefan Mandel mastered how the EV worked for lotteries and used his expertise to take advantage of conditions when lotteries would be a safe bet.

You need to match six numbers drawn from 1 to 49 to win the National Lottery, of which there are 14 million potential combinations, which ensures that the chance to win is 14 million to one. To be a lucrative gamble, the return of the jackpot would have to be higher than the odds. Still, lotteries prefer to act as a risk-free method for governments to raise treasury funds, so the odds usually exceed the return, as mentioned above.

A ranking of prevalent gambling behaviors (in terms of EV) from bingo to blackjack will have broad lotteries at the bottom. As an example, the UK National Lottery has a 50p negative EV for each £1 staked (so -0.50p). That is why it derided as a form of indirect taxation. Lottery players, of course, are willing to put down their money, even when given with the EV figure – or an equivalent claim – Seeing the 50p as the cost of buying the thrill of getting in with the chance of winning a life-changing amount of money (no matter how little the probability is).

However, the standard EV of the lottery is an exception. The jackpot rolls over when a winning ticket not sold for a draw, will add up with the jackpot for the next draw. If a jackpot rolls over a large number of times, it will rise to a point where the EV is positive. Mandel understood that and set out to find a way of leveraging it.

The theory is simple. Wait for a reasonably large rollover, and then cover all permutations necessary. The immense logistical consequences – Mandel had to purchase tickets to cover all permutations – this has been in the local convenience store for a long time. To the magnitude of the difficulty, he succeeded (on several occasions) in the monumental task. His outlay was less than the jackpot, which he scooped (mainly due to the lack of a common winner) having purchased tickets for any possible combination of numbers.

The theory of manipulating particular circumstances of positive EV is at work when card counters attempt to get the best of blackjack table casinos, concentrating on brief conditions where the deck’s make-up gives the player a possible advantage over the house.

Positive EV & Arbitrage

Arbitrage is the explicit manipulation of odds from a separate turf accountant to provide a positive EV when placed together to create an artificial market.

Arbitrage is an increasingly common method of betting, and has been a practical and legal basis for many decades of financial trading. Arbitrage is not a flakey method-the theory of mathematics is irrefutable. The problem lies with other turf accountants’ inability to tolerate arbitrage bettors, which is where some turf accountants stand out, running a welcoming policy of arbitration.

Implicit EV

While arbitrage trading takes advantage of precise positive EV circumstances, opportunities are tangible if fleeting. In essence, there are also circumstances where the positive value can be inferred, arising from a difference of opinion. Serious bettors create their handicap systems and thus produce their views of a given market. They consider positive EV based on their estimation when the odds that their system provides vary widely from what a turf accountant is offering.

This is possibly the case in niche markets, where the playing field between turf accountant and individualistic bettors is even more so. This will generate a decision matrix in which you obtain odds that are better than those indicated by the bet, and therefore the wager will earn you a benefit in the long run.

EV may have been developed by a genius mathematician grappling with the toughest problem of all, yet it is probably best suited to humbler means. This is an excellent betting method to assess how effective a bet could be. When you haven’t used it, you don’t need to turn to a decision matrix to explain why.